Kuala Lumpur’s short‑term rental (STR) and Airbnb market has matured from a “grey area side hustle” into a data‑backed, regulation‑driven asset class that serious investors can no longer ignore. This article breaks down the latest numbers and rules so that international buyers and high‑net‑worth Malaysians can make informed decisions about owning a STR‑ready condo in KL city Centre.

1. Why Malaysia’s vacation rental market matters now

Recent vacation rental data for Malaysia shows:

- The vacation rental segment (including platforms like Airbnb) is projected to keep growing in revenue and guest nights through the second half of the decade, supported by tourism recovery, Visit Malaysia 2026, domestic travel and rising digital nomad traffic.

- Airbnb’s own economic‑impact study found that in 2024, guests spent RM11 billion in Malaysia, combining accommodation and non‑accommodation spending.

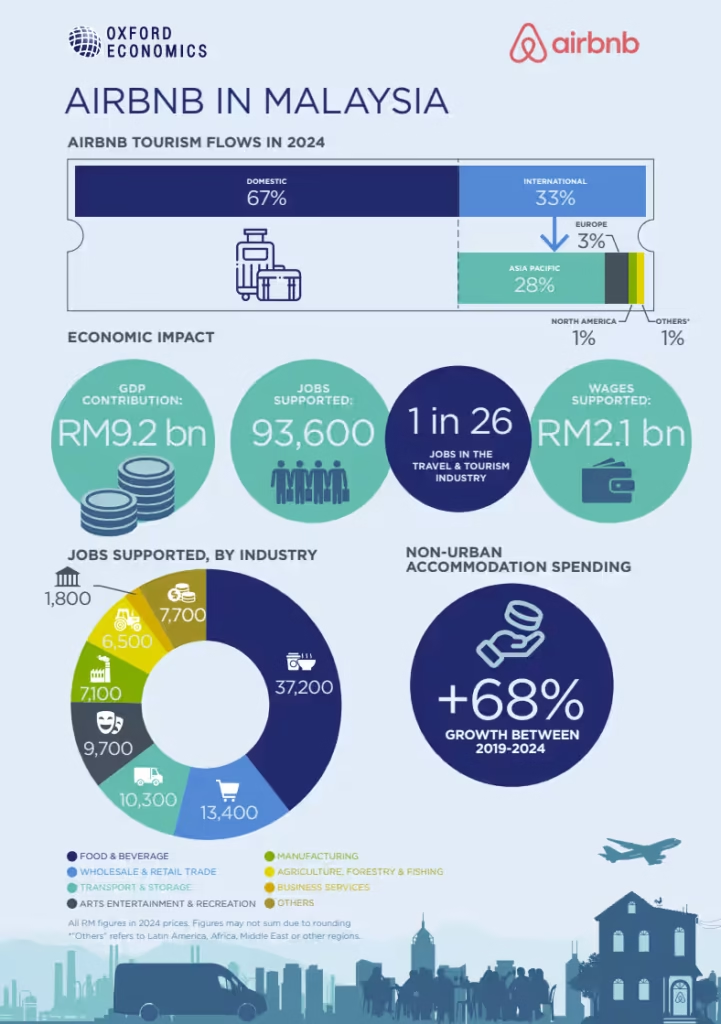

- This activity contributed RM9.2 billion to GDP (0.5% of the economy) and supported about 93,600 jobs—around 1 in 26 tourism jobs.

For a buyer looking at a KL city condo, this means you are no longer just buying a unit and “hoping for tenants.” You are plugging into a measurable, multi‑billion‑ringgit tourism and STR economy.

2. Who actually stays in Malaysian Airbnbs? (International demand)

The Oxford Economics report commissioned by Airbnb shows a demand profile that aligns very well with your target markets as a seller or landlord:

- 67% of Airbnb guests are domestic, while 33% are international, giving a stable, diversified base.

- Among international guests in 2024, the Asia‑Pacific region accounts for 28% of all guests and over 80% of all international visitors.

- Top 3 source markets for inbound Airbnb guests:

For owners and agents, this provides clear messaging:

- Singaporeans and Indonesians see Malaysia as a quick, affordable getaway.

- Chinese travellers are returning and increasingly using platforms like Airbnb for multi‑day stays.

This is particularly relevant for condos in KLCC, Bukit Bintang, TRX Corridor, and KL Sentral, which are usually the first choice for these travelers due to connectivity and international branding.

3. How much do Airbnb guests spend in Malaysia and in KL?

Airbnb and Oxford Economics quantify both length of stay and daily spend:

- The typical Airbnb guest stays about 2 nights and spends around RM640 per day on non‑accommodation items such as food, shopping, entertainment and transport.

- For every RM1,000 of non‑accommodation spending:

Kuala Lumpur’s share

- In Kuala Lumpur alone, Airbnb guest spending reached around RM4.4 billion in 2024, accounting for 39% of all Airbnb guest spending in Malaysia.

- This supported an estimated:

For a KL city centre owner, these numbers help demonstrate:

- Short‑stay tourism is a major driver of F&B and retail around your asset.

- STR‑friendly properties can be legitimately positioned as “income‑generating lifestyle investments,” not just speculative flips.

4. Airbnb regulation in KL and Malaysia: from grey to governed

No nationwide ban, but a formal licensing regime is coming

Malaysia is moving towards a national Short‑Term Rental Accommodation (STRA) framework rather than a ban:

- A proposed STRA framework will require hosts to obtain business licences from local councils and register accommodations as tourist facilities.

- The framework is expected to plug into amendments to the Tourism Industry Act 1992, covering licensing, data‑sharing, platform responsibilities and a Tourism Tribunal for disputes.

This means that going forward a KL Airbnb unit should be treated as a regulated micro‑hospitality business, not a casual side gig.

Current KL situation

- There is no specific law in Kuala Lumpur outright banning Airbnb, but STR may be treated as commercial use under the National Land Code and local zoning, depending on the council and building.

- Airbnb hosts in Malaysia no longer collect Tourism Tax directly, but STR properties remain under the tourism‑tax framework and must comply with building, fire, and safety standards.

Court of Appeal clarity and strata by‑laws

- A 2025 Court of Appeal ruling has reinforced that strata owners must comply with valid management by‑laws and national STR guidelines, empowering management corporations (MCs/JMBs) to regulate or even prohibit daily/weekly rentals if properly adopted.

For international and local high‑net‑worth buyers, this highlights a crucial due‑diligence step:

- Do not just ask “Is Airbnb legal in Malaysia?”;

- Ask: “Does this specific building and zoning allow STR—and under what conditions?”

5. Tax and policy: Budget 2026 and foreign buyers

From 1 January 2026, Malaysia has shifted towards a more selective stance on foreign residential buyers:

- Stamp duty for foreign individuals and foreign‑owned companies on residential property now effectively increases from 4% to up to 8%, depending on bands and value, roughly doubling transaction tax at the upper end.

- At the same time, Malaysian citizens continue to enjoy full stamp‑duty exemptions for first homes up to RM500,000 (extended to 2027), signalling that policy favours local home‑ownership while still welcoming long‑term foreign capital at higher price points.

For an international buyer or high‑net‑worth Malaysian investor in KL city centre, the message is:

- The government is discouraging short‑term speculation.

- Long‑term, professionally managed rental and holiday‑home strategies are still welcomed.

6. KL city centre as an investment story in 2026

Strong fundamentals in core districts

Recent KL market insights show:

- Kuala Lumpur recorded around 6.1% annual rent growth with a 1.9% quarter‑on‑quarter increase in early 2025, indicating robust rental demand in key locations.

- Prime city‑centre areas—KLCC, Bukit Bintang, the TRX corridor and KL Sentral/Brickfields—continue to attract both expatriates and tourists, with price levels still below other major Asian capitals such as Singapore and Hong Kong.

Pair this with Airbnb’s data on KL’s RM4.4b guest spending, and the case for high‑quality city‑centre condos as income‑producing assets becomes stronger.

High‑rise preference and foreign ownership rules

- National residential analysis shows Malaysia’s market is increasingly high‑rise‑driven, with apartments and condos making up around 70% of urban residential stock due to land constraints and buyer preference for facilities and security.

- Foreigners can directly own freehold or leasehold strata property (condos/serviced apartments) with state‑set minimum purchase prices—generally around RM1,000,000 in Kuala Lumpur—while landed homes are more restricted.

This aligns naturally with STR and mid‑term rental plays: most international investors in KL city centre are already buying the asset class that regulators are most comfortable with foreign ownership.

7. How Airbnb supports Malaysia’s wider economy for owners

Airbnb’s economic footprint is not just about hosts and guests; it spreads across many sectors:

- Manufacturing benefits the most in GDP terms (about RM1.4b), because F&B outlets, retailers and other tourism businesses buy local goods.

- Transport & storage and food & beverage sectors each see around RM1.2b in GDP contribution from Airbnb‑related activity.

- Employment supported by Airbnb in 2024 includes:

Note:

- A well‑regulated STR ecosystem does not just benefit owners; it supports restaurants, retail, logistics and creative industries across Malaysia.

8. Practical tips for international and High NetWorth buyers eyeing KL Airbnb assets

1. Choose the right building and zoning

- Confirm whether the project is in an area where STR is acceptable to the local council and land use category.

- Check MC/JMB by‑laws, EGM/AGM decisions and house rules to ensure STR is expressly allowed and under what minimum stays (e.g. nightly vs 30‑day).

2. Underwrite deals with realistic occupancy and costs

- Use conservative assumptions based on market benchmarks (e.g. 50–60% occupancy, realistic nightly rates for your unit type and micro‑location, full operating costs including management, cleaning, licensing, tax and maintenance).

3. Align with upcoming STRA licensing

- Factor in future licensing fees, compliance requirements and possible caps on the number of units per building or per host.

- Consider professional management or co‑hosting arrangements to ensure 24/7 compliance and guest handling.

4. Think “dual‑use”: holiday home + mid‑term rental

- Many high‑net‑worth Malaysians and international buyers use KL city units as a personal base during visits while renting them out as mid‑term (1–6 month) stays for executives, digital nomads and medical tourists in between.

5. Invest with a 7–10 year horizon

- With higher stamp duty and tightening policy globally, STR investments work best as long‑term holds where capital appreciation, currency diversification and recurring income all play a role.